Over the past few years the trend in fintech has been the democratization of services that have usually been reserved for the wealthy. Now, companies are building products that allow everyday people to have access to these strategies. One that has always plagued me is the concepts of family offices. Family offices are essentially entire teams of people that help manage a family’s wealth. They track everything involved with that family’s finances. For a while I did not think it is something you could bring to the public. The technology was too complex and complicated to build.

But with most technology, advancements were made that bring new opportunities to the forefront. In the last few months, I have been seeing many blogs, tweets, and podcasts that talk about the AI revolution in fintech. Many dubbing it the “AI Era” in fintech. More on that here.

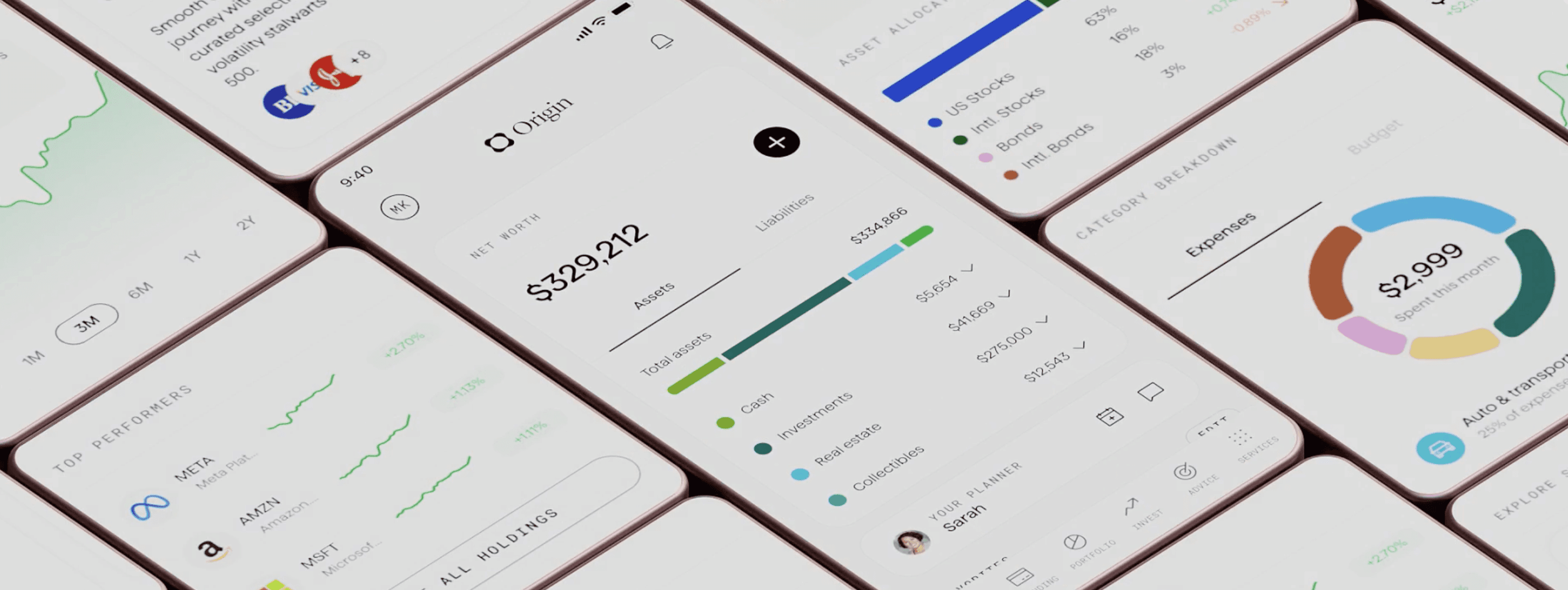

Well, I think AI provided the ability to bring a “family office” to your phone. And Origin is leading the pack here.

My Thoughts

The Origin app is one of those apps that feels too big to be on your phone. There is so much that can be done in the app from investing, to net worth tracking, equity tracking, budgeting, taxes, and much more. It is capable of doing really whatever you want when it comes to finances, making it feel like an entire family office. I personally prefer the website experience for this reason, it is easier for me to manage and see everything from a larger screen.

I use many different services to invest and manage my money. It’s annoying to log into every app every day and make sure that everything is performing how it should. It is also tough for me to know where I am currently underinvested. Right now, it’s more of just a feel thing. If I feel I need more in one place and less in another, I will make that change. Having that family office high level overview is something that I like to have in one place. It helps me make better decisions.

That is where I use the app the most, managing the high level overview of where my money is. I don’t do much budgeting and transaction watching, simply because I have never felt that I do not have a handle on that side of my finances. I do appreciate how you can work this method within the Origin app, you can go as big or as small as you want. If you want to track every penny, you can do that, if you want to just do investments you can also do that.

Pushing forward

Recently, Origin has started to push forward from tracking your money to actually investing and giving you new investment products. You have the ability to open a high-yield savings account, buy individual stocks, and buy stock bundles (similar to an ETF, but better). The push to invest money within Origin allows users the option to start to concentrate their holdings under one “office”.

On a side note, when talking to friends about investing, I heard a few people mention Charles Schwab stock bundles and found the concept extremely interesting. The ability to choose and manipulate which stocks in a certain theme you want gives users the ability to essentially have a say in what goes into their own “etfs”.

What I still want

Origin is starting to become the family office on your phone, but I am still missing the personalization side that I want. To me I want a weekly summary of where all my accounts are and the big moves that were made last week. Every Monday morning and after every paycheck, I want to know where all my accounts stand, where money has moved, and what has the best returns YTD. This would allow me to be confident weekly that I know where everything is. This can snowball into quarterly and yearly reports as well.

And I think Origin already has a big part of this figured out with Sidekick AI. The ability to ask an AI something about your finances at any moment is huge. It’s like your own FA. Since Sidekick already has the ability to respond to questions revolving around your data, this should all be included in this weekly report depending on your changing priorities.

Just me

All this to say everyone’s financial situation is extremely personal and different. This is just what I want in my wealth management app. What other people want is highly dependent. I hypothesize that other people would also appreciate this type of feature, but that is only something that data and user interviews would be able to answer.

Excited to watch Origin continue to innovate and move forward.

Disclosures: I am currently a paying user at both Titan and Origin Financial

-Tom Lombardozzi

thomas.lombardozzi@gmail.com

Your Own Family Office

Tom Lombardozzi